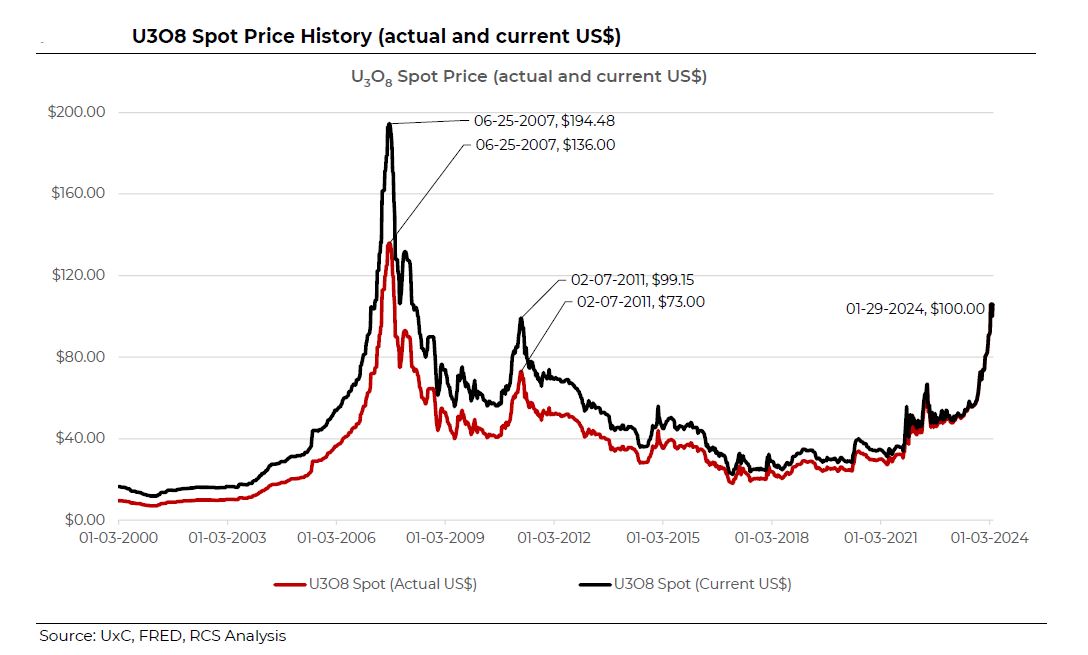

The Greatest Uranium Bull Market is Dawning

Uranium Companies Analyst Ratings are now available: https://uraniumequities.com/analystratings/

Our Top Pick

Urano Energy is a mineral exploration company focused on conventional uranium projects in the United States. With a preference for uranium projects in progressive jurisdictions, Urano leverages its access to large U.S. historic proprietary databases to acquire and advance previously explored conventional uranium projects.

Urano Energy is a mineral exploration company focused on conventional uranium projects in the United States. With a preference for uranium projects in progressive jurisdictions, Urano leverages its access to large U.S. historic proprietary databases to acquire and advance previously explored conventional uranium projects.

“Golden Rules” for Choosing Uranium Stocks:

1. Study the credentials of the company’s management team

2. Investigate the uranium property’s pedigree, a property’s past ownership and its institutional memory

3. Find out if a company is moving its flagship project(s) forward

4. Find out where the company’s uranium ore will be milled

5. Find out if the mining area is environmentally friendly or not

6. Political Risk

7. Find out about the depth of the company’s property portfolio

8. Find out if a company has partnered with a major company or institution

9. Find out how much money the company has raised

10. Find out if the company is likely to be a takeover candidate

Uranium ETFs

Sprott Uranium Miners Fund (NYSE Arca: URNM)

Sprott Junior Uranium Miners ETF (Nasdaq: URNJ)

Sprott Energy Transition Materials ETF (Nasdaq: SETM)

Horizons Global Uranium Index (HURA)

VanEck Uranium and Nuclear Technologies UCITS

Global X Uranium UCITS ETF (URNU LN)

Betashares Global Uranium ETF (ASX: URNM)

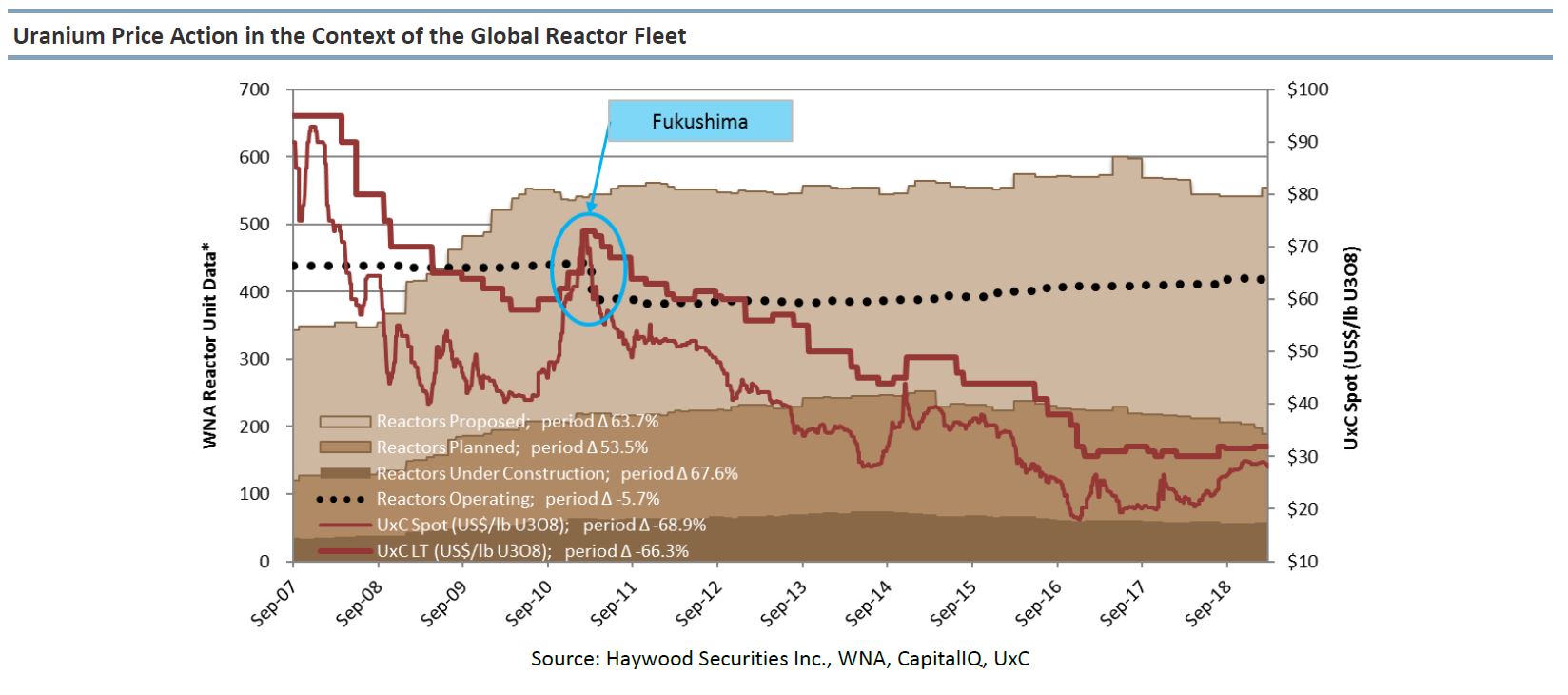

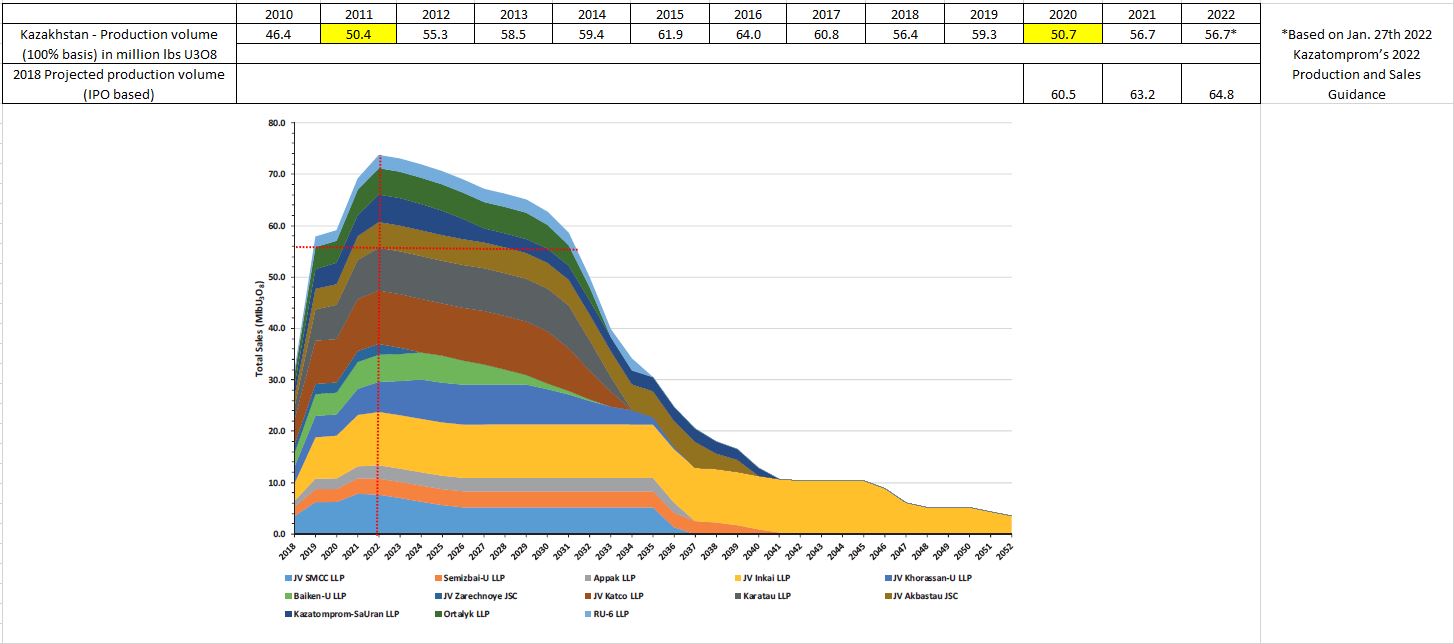

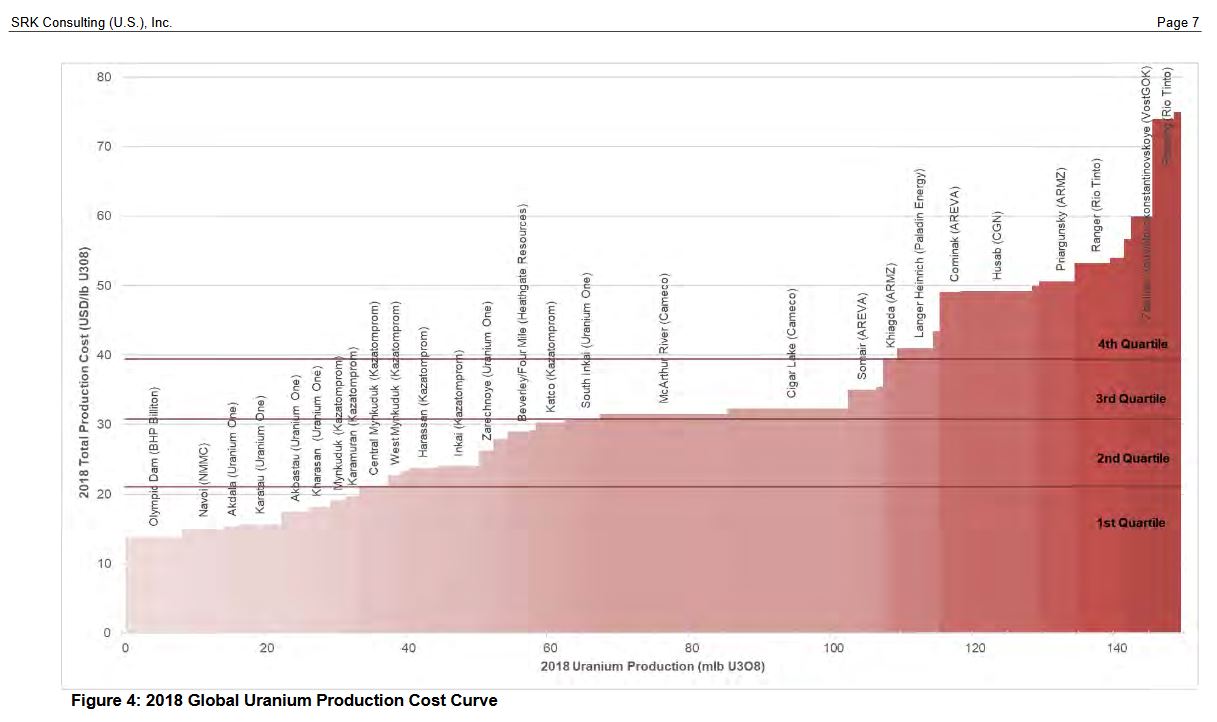

Uranium Production – Expectations vs. Reality

Mike Alkin: “In my entire 20-plus year career as an analyst, this is the best risk/reward ratio on the long-site I’ve ever seen”

Doug Casey: “When the market wants into gold stocks it’s like trying to force the contents of Hoover Dam through a garden hose. In the case of uranium stocks, it’s more like a soda straw.”

Rob Chang: “Gear up for a violent uranium price spike!”

Feb 6, 2021 – Hugh Hendry: “A lot of you are invested in uranium. I commend you. I wish I was. Uranium is the rockstar of commodities. It doesn’t mess around – bull and bear markets are of epic proportions.” https://twitter.com/hendry_hugh/status/1358107357516083202?s=20

Feb 14, 2021 – Michael Burry Joins The Uranium Craze: https://www.zerohedge.com/markets/michael-burry-joins-uranium-craze

March 31, 2021 – Marcelo Lopez: “I have never been as bullish on uranium as I am today, but probably a bit less bullish than what I will be tomorrow” https://www.youtube.com/watch?v=3WHI9cDyA7k

April 04, 2021 – ZeroHedge: “One Step Away From “ESG”: Why Uranium Stocks Are About To Soar” https://www.zerohedge.com/markets/one-step-away-esg-why-uranium-stocks-are-about-soar

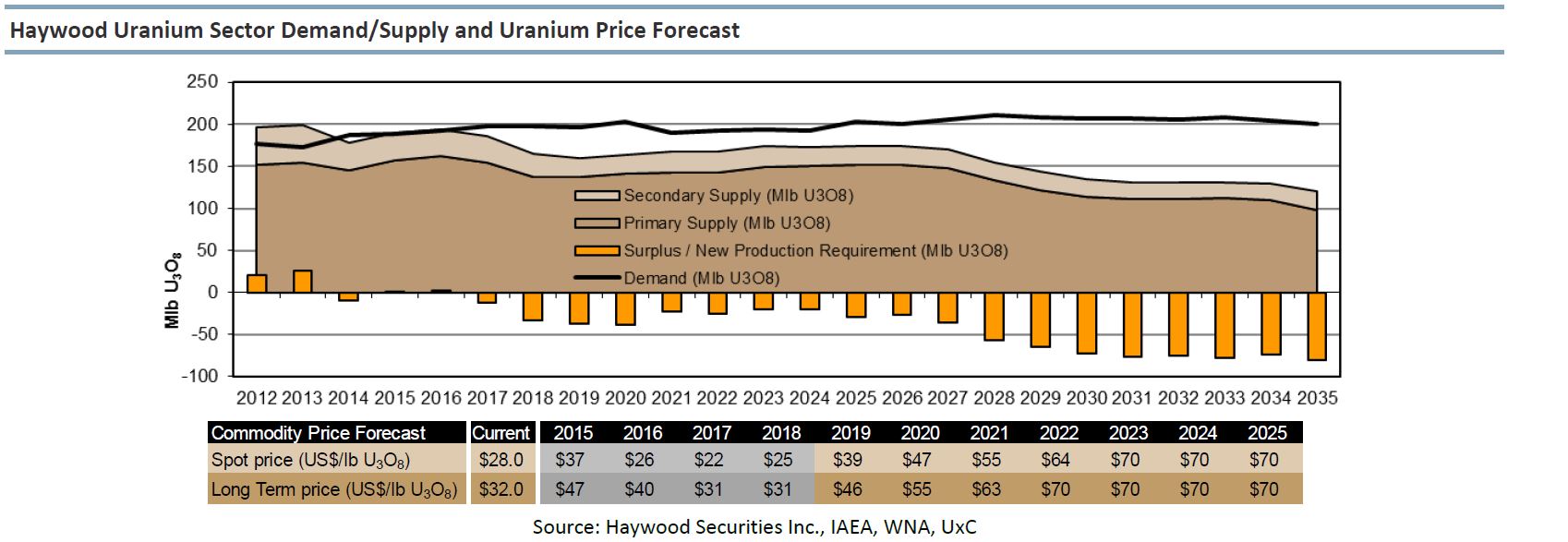

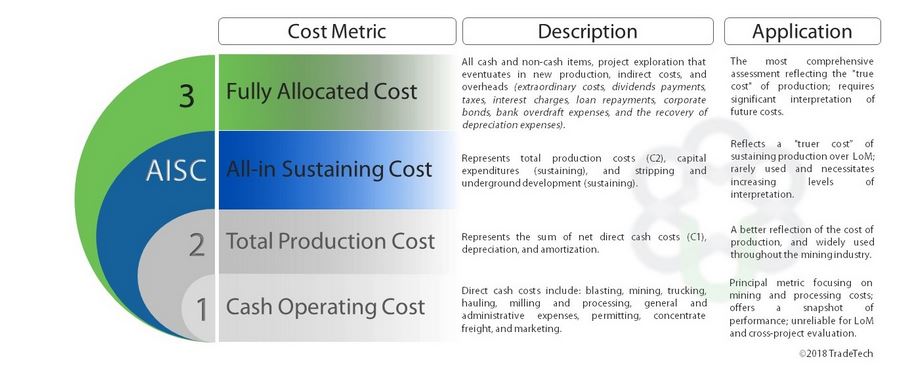

Basic Economics: You can’t spend $60 a pound to make uranium and we sell it for $35 a pound. Either the uranium price goes up or the lights go out!

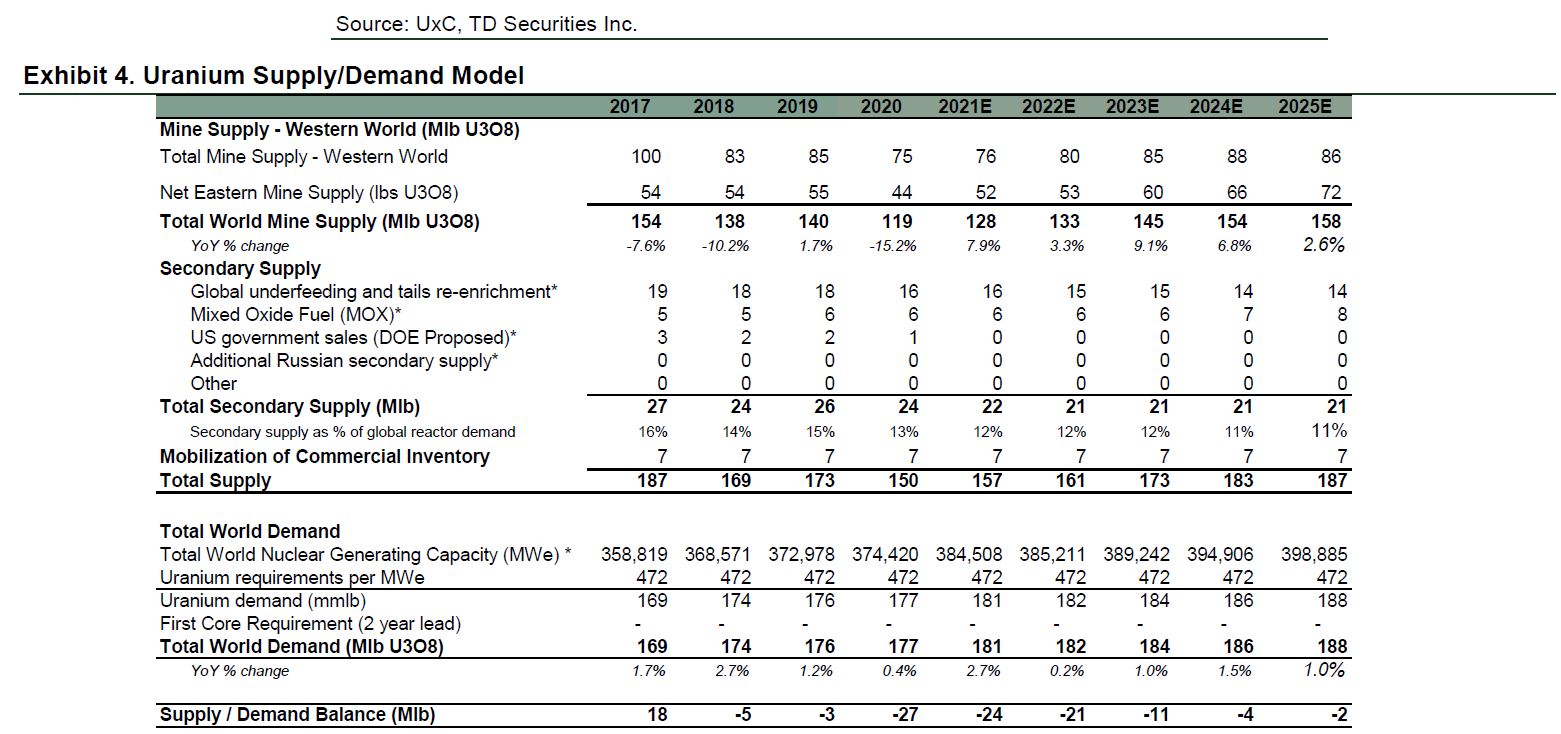

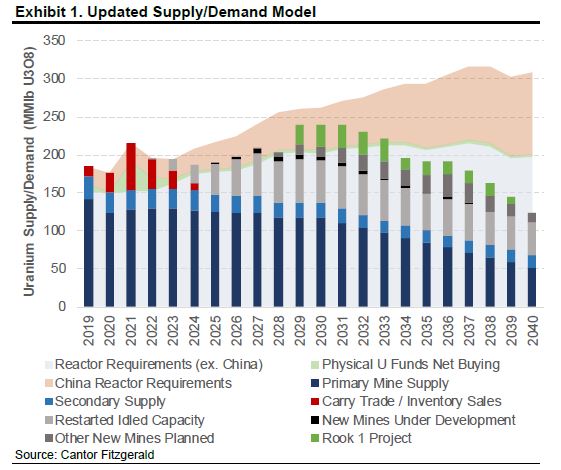

Cantor Fitzgerald Supply/Demand Model

Position Your Portfolio for a Nuclear Decade